Payment Standards

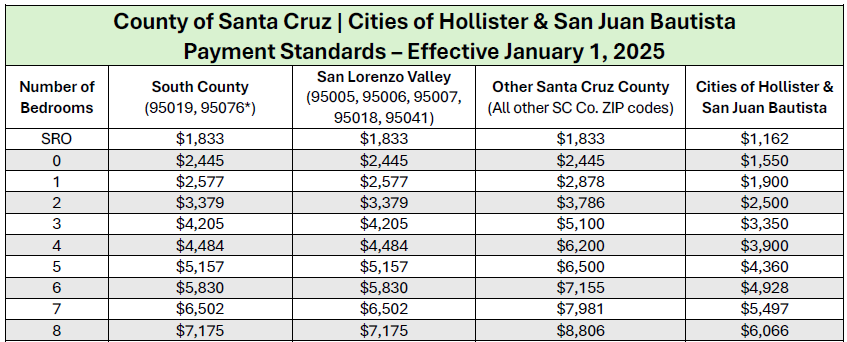

Payment standards represent the maximum monthly rental assistance a tenant can receive toward gross rent. Gross rent includes the contract rent for the unit plus the estimated monthly cost of the tenant-paid utilities, known as the utility allowance (see the links under “Utility Allowances” below for the current utility allowance schedules). The table below provides the current payment standards for all of Santa Cruz County and the cities of Hollister and San Juan Bautista.

PS1 Payment Standards for Santa Cruz County and the cities of Hollister and San Juan Bautista

*Units in La Selva Beach with ZIP code 95076 are considered Other Santa Cruz County

The contract rent may be set above the payment standard, but it is subject to rent reasonableness and the 40% affordability rule (see Rent Approval Process).

Rent Approval Process

Click here for Rent Calculator

Click here for a Rent Calculation Flyer for Owners

Gross Rent

The gross rent is the rent charged by the owner plus an estimated average monthly amount tenants will pay for utilities (utility allowance) assuming normal consumption. The gross rent represents the entire housing cost and is calculated as follows:

- Gross rent = contract rent + utility allowance

- Contract rent = rent charged by owner

- Utility allowance = estimated monthly cost of tenant-paid utilities

Note: If all utilities are included in the rent, the rent to the owner and the gross rent will be the same.

Tenant’s Contribution

The tenant’s contribution is calculated at 30% of their monthly adjusted income.

Housing Assistance Payment

The housing assistance payment is calculated by subtracting the tenant’s contribution from the lesser of

- the gross rent or

- the applicable payment standard.

Note: The housing assistance payment is the rental assistance the Housing Authority pays to the owner on behalf of the tenant.

If the gross rent exceeds the applicable payment standard, the tenant’s contribution is adjusted to cover the remaining balance.

Note: The tenant is responsible for any amount over the payment standard plus 30% of their monthly adjusted income.

Maximum Rent Burden at Initial Occupancy

The tenant’s contribution is checked against the maximum rent burden known as the 40% affordability rule.

- 40% affordability rule – tenants may not pay more than 40% of monthly income toward gross rent.

- If the tenant’s contribution exceeds 40% of their monthly adjusted income, the Housing Authority will request a lower contract rent from the owner.

Note: The 40% affordability rule applies to the initial lease term only.

Rent Reasonableness

The Housing Authority must determine rent reasonableness of the unassisted unit.

- Rent reasonableness verifies that contract rent charged to the unassisted unit is comparable to at least three similar unassisted units.

- Rent reasonableness considers unit type, location, size, amenities, and utilities.

Note: The Housing Authority may request a lower contract rent at this time.

Rent Approval

The Housing Authority will approve the rent if the contract rent is determined to be reasonable and the tenant’s contribution is 40% or less of their monthly adjusted income.

Rent Increase Limit (AB 1482):

Under the California Tenant Protection Act of 2019 (AB 1482), most tenancies are subject to rent increase limitations. The law prohibits an owner from increasing the rent more than 5% plus the percentage change in cost of living, or a maximum of 10%, whichever is lower, over the course of any 12-month period. Additionally, owners may also be limited to only two increases within a 12-month period.

The California Attorney General confirmed that AB 1482 applies to most tenancies assisted with Housing Choice Vouchers. HUD encourages HACSC to verify compliance with AB 1482 to ensure compliance with HUD requirements at 24 CFR 982.509. If your rent increase request appears to violate the rent control requirements of AB1482, HACSC will be unable to approve the increase and HACSC will ask you to revise the request.

Certain properties are exempt from AB 1482. When submitting a request for a rent increase, please note that it is your responsibility to inform HACSC if your property is exempt along with the basis for the exemption. HASCSC will not determine this for you. If you would like to claim an exemption, you must provide documentation that verifies the exemption. HACSC will then confirm if that exemption applies.

HACSC suggests that you contact an attorney or other legal entity for more information about limitations on rent increases.

FAQS – PAYMENT STANDARDS

What are payment standards?

Payment Standards represent the maximum monthly rental assistance that a family can receive for rent and utilities in Housing Choice Voucher (HCV) programs.

Payment standards do not represent the maximum monthly rent that an owner can charge.

How are payment standards determined?

Payment standards are set by the Housing Authority as a percentage of the local Fair Market Rents, which are updated annually by the U.S. Department of Housing and Urban Development (HUD).

How are payment standards used?

Payment standards are used to calculate the housing assistance payment that the Housing Authority pays to the owner on behalf of the family leasing the unit. The tenant pays a percentage of their income toward rent, and the Housing Authority pays the remaining balance – up to the lesser of the contract rent or applicable payment standard – to the owner.

Which payment standard applies to my unit?

In the Housing Authority jurisdiction, which includes all of Santa Cruz County and the cities of Hollister and San Juan Bautista, payment standards vary by ZIP code and number of bedrooms. To find the payment standard that applies to your unit, do the following:

- Determine the ZIP code for the unit’s address

- Determine the lesser of the

- Tenant’s voucher size, or

- Number of bedrooms in the unit

- Find the corresponding payment standard on the table that matches those figures

What payment standard do I use if I am renting out one or more bedrooms in a larger unit with two or more families?

Shared Housing is a multi-bedroom unit occupied by two or more families who share common spaces, such as a kitchen and living room, but maintain private bedrooms.

To calculate a payment standard for shared housing, do the following:

- Determine the applicable payment standard for the size of the entire unit (based on ZIP code and number of bedrooms)

- Divide that amount by the number of bedrooms in the entire unit

- Multiply the result by the number of bedrooms the assisted family will occupy

Can I charge rent that is more than the payment standard?

Yes, the Housing Authority may approve contract rent that is greater than the applicable payment standard, but it is subject to the 40% affordability rule* and rent reasonableness regulations.

Please see “What is the 40% affordability rule?” and “What is rent reasonableness?” for an explanation of these policies.

*Note: The 40% affordability rule applies to initial lease term only

What is the 40% affordability rule?

The 40% affordability rule prohibits a tenant from paying more than 40% of their monthly adjusted income toward rent during the initial lease term*. This rule makes sure that a unit is affordable for the tenants.

If the gross rent (contract rent + utility allowance) is greater than the payment standard, the tenant is responsible for paying the amount over the payment standard plus their portion of the rent that is based on 30% of their income. If the tenant’s new payment is more than 40% of their monthly income, contract rent will not be approved, and the Housing Authority will request a lower rent from the owner.

*Note: The 40% affordability rule applies to initial lease term only. Rent increases are not subject to the 40% affordability rule.

What is rent reasonableness?

Rent reasonableness ensures that the rent requested by the owner is reasonable. The Housing Authority determines rent reasonableness by comparing the contract rent to at least three similar unassisted units and considers unit type, location, size, amenities, and included utilities.

If contract rent is determined to not be reasonable, it will not be approved, and the Housing Authority will request a lower rent from the owner.

Rent reasonableness applies to the initial lease term and for every rent increase.

What is the utility allowance?

The utility allowance is an estimate of the monthly cost of tenant-paid utilities, assuming normal consumption. Utilities are considered part of gross rent.

How do I calculate the utility allowance for my unit?

To calculate the utility allowance for your unit, review the applicable utility allowance schedule (UA1, UA2) below and do the following:

- Determine the unit type and choose the appropriate table

- Determine the lesser of the

- the family’s voucher size, or

- the number of bedrooms in the unit

- Use the column that matches that result and add up the values for the utilities the tenant will pay

If I want my tenant to only pay 30% of their monthly income on rent, how much should I charge?

To establish a rent that ensures your tenant will only pay 30% of their monthly income, do the following:

- Determine the applicable payment standard (see “Which payment standard do I use for my unit?”) Determine the utility allowance (see “How do I calculate the utility allowance for my unit?”)

- Subtract the utility allowance from the payment standard

- Use that amount for your contract rent

Note: Please keep in mind that rent reasonableness still applies.

If you would like assistance with this calculation, please call Housing Authority staff at 831-454-5955.

How can I estimate the tenant’s portion of rent and the housing assistance payment?

Click here for Rent Calculator

In general, to determine the tenant’s rent portion and the housing assistance payment, do the following:

- Calculate the gross rent (contract rent + utility allowance)

- Subtract 30% of the tenant’s income from the lesser of the

- Applicable payment standard, or

- Gross rent

Note: This value is the housing assistance payment you will receive from the Housing Authority each month.

- Subtract the housing assistance payment from the contract rent.

Note: This is the amount of rent that you should collect from the tenant each month.

Please keep in mind that this calculation should only be used to help you estimate the rent breakdown. The Housing Authority will determine the official amounts and must complete the 40% affordability rule* and rent reasonableness checks.

*Note: The 40% affordability rule applies to initial lease term only

Utility Allowance

Utility allowances are subject to change without notice. For current utility allowance data for the County of Santa Cruz and the cities of Hollister and San Juan Bautista, please refer to the links provided on this website.

UA1 Santa Cruz County Utility Allowances

UA2 Hollister and San Juan Bautista Utility Allowances

What is utility allowance?

The utility allowance is an estimate of the monthly cost of tenant-paid utilities. Utilities are considered part of rent.

How do I calculate the utility allowance for my unit?

To calculate the utility allowance for your unit, review the applicable utility allowance schedule (UA1, UA2) and do the following:

- Determine the unit type and choose the appropriate table

- Determine the lesser of the

- the family’s voucher size, or

- the number of bedrooms in the unit

- Use the column that matches that result and add up the values for the utilities the tenant will pay

Income Limits

Income limits for the Housing Choice Voucher.

IL1 Santa Cruz County, Hollister and San Juan Bautista – Federal Program

IL2 Santa Cruz County – State Program

IL3 Santa Cruz County – Homeownership and other Local Programs